property tax assistance program illinois

Check Your Eligibility Today. The homeowner will need to pay each and every monthly or quarterly installment.

Cool Property Tax Appeals To Lower Property Taxes Find Your Reason To Appeal Homeowners Guide Property Tax Homeowner

However please note that beginning FY 20 any recipient of the PTRG will need to file the abatement for 2 years.

. Districts must apply annually if they wish to be considered for the future grant cycles. The program requirements include. This credit equals five percent of the Illinois Property Tax you need to pay for your residence.

2 The amount of tax relief is relatively minor. To access this page you must be a local government official. I hope this information helps you Find.

Ad This is the Newest Place to Search. 27610 for a household of one. Information pertaining to Delinquent Tax Information as well as resources.

Illinois property tax bills are on their way and payment is due in June. Your household income from all sources for the prior year must be below 55000. Tax Relief Exemptions.

In order to provide you with the best possible service applications for some services that we offer may require an appointment. Its free to sign up and bid on jobs. The Karpfs pay 10000 a year in property taxes.

The Circuit Breaker Property Tax Relief program provides rebates to qualified seniors for rent property taxes or nursing home charges. Under the proposed relief ordinance interest penalties for late payments of the second installment of property taxes which are normally due August 3 will now be postponed until October 1. Ad Do You Need To Set Up An Illinois State Payment Plan.

Please call 815 722-0722 for additional information on applying for services. The applicant will need to be the owner of the real estate property according to the assessors records. Own and occupy a property.

For more information call us at 217 785-1356. Will my Property Tax Relief Grant PTRG be added to my Base Funding Minimum. Your household income from all sources for the prior year must be below 55000.

Before sharing sensitive information make sure youre on a City of Chicago government site. This is a fairly large discount and can help people save a. The amount of tax relief is relatively minor.

2022 Latest Homeowners Relief Program. Low-Income Assistance Community Action Agencies CAAs offer a variety of services to assist individuals and families in moving towards self-sufficiency. You may qualify for a senior freeze if you are.

If you apply and are qualified for this property tax. There may be some assistance available for delinquent property taxes in Winnebago County Illinois. Senior citizen tax deferral There is also a loan program to help homeowners who are 65 by June 1 of the relevant tax year.

Delivering Top Results from Across the Web. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Beginning January 1 2001 legislation will take effect that may significantly increase the cost of the Circuit Breaker Program.

Read a taxpayers guide to property tax relief. We have funds available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Illinois homeowner. Seniors with income of less than 45000 a year can expect rebate amounts ranging from 1 to 350.

The Property Tax Relief Grant PTRG is a one year grant program. Local Officials Only Restricted Area - Here you will find local government forms and other information specifically for local government officials. I recommend that you visit the Illinois Property Tax Appeal Board Taxpayer Assistance Web page to learn about what assistance may be available.

Senior Citizens Real Estate Tax Deferral Program This program allows persons 65 years of age and older to defer all or part of the real estate taxes and special assessments up to a maximum of 5000 on their principal residences. Over 60 years old. CHICAGO Governor JB Pritzker and the Illinois Housing Development Authority IHDA today announced the Illinois Homeowner Assistance Fund ILHAF will open on April 11 2022 to help homeowners who have fallen behind on mortgage payments and related housing expenses during the COVID-19 pandemic.

The Illinois Homeowner Assistance Fund ILHAF is a federally funded program dedicated to assisting homeowners who are at risk of default foreclosure or displacement as result of a financial hardship caused by the COVID-19 pandemic. Property tax assistance program illinois Wednesday April 13 2022 Edit. This program establishes assessment reductions for multifamily rental developments subjected to certain rent tenant income and related restrictions.

Check If You Qualify For 3708 StimuIus Check. To qualify for this type of credit you have to own and reside in the property. Of course the homeowner must have been delinquent on paying their property taxes and it usually needs to be a recent issue and hardship that the person is facing.

Any payments made on or before October 1 for property tax second installments will be considered filed and paid on time by Cook County Treasurer Maria Pappas. Search for jobs related to Property tax assistance program illinois or hire on the worlds largest freelancing marketplace with 21m jobs. It is estimated that in 2000 the Program will provide 560 million in property tax relief and 453 million in pharmaceutical assistance to Illinois senior citizens.

Ad A New Federal Program is Giving 3252 Back to Homeowners. Therefore the Circuit Breaker program alone cannot solve the. Senior Citizens Property Tax AssistanceSenior Freeze.

Dont Miss Your Chance. Homeowners with household incomes less than 150 of the Area Median Income. To see if you qualify give us a call today at 312-626-9701 or fill out the form below to have one of our representatives give you a call.

A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax bills. If so you may qualify for a state loan of up 5000 to pay current property tax bills. A limited number of applications are taken each day.

The Affordable Housing Special Assessment Program incentivizes the rehabilitation and new construction of multi-family residential properties to create and maintain affordable housing. Applications are taken Monday through Friday from 8am 3pm on a walk-in basis. Find Out If You Qualify.

Look For Awesome Results Now. The Illinois Property Tax Credit Can Help You Reduce Your Taxes You can use the Illinois Property Tax Credit on your income tax return. Federal funding is provided to Illinois 36 Community Action Agencies to deliver locally designed programs and services for low-income individuals and families.

Check If You Qualify For This Homeowner Relief Fast Easy. With many families and businesses losing income due to the stay-at-home order amid. 31 rows Part 530 - Senior Citizens Disabled Persons Property Tax ReliefPharmaceutical Assistance.

Credit Repair Newsletter Asap Credit Repair Usa Reviews Credit Repair Specialist Course Asap Cred Rebuilding Credit Credit Repair Companies Good Credit

Illinois Department Of Revenue Facebook

Even In Hong Kong Taxes Are No Game Businessregistration Hong Kong Will Help You Get It Right For A Maximum Score Tax Debt Tax Debt Relief Debt Calculator

Property Tax City Of Decatur Il

Pritzker To Offer Relief On Groceries Gas Property Taxes Illinois News Us News

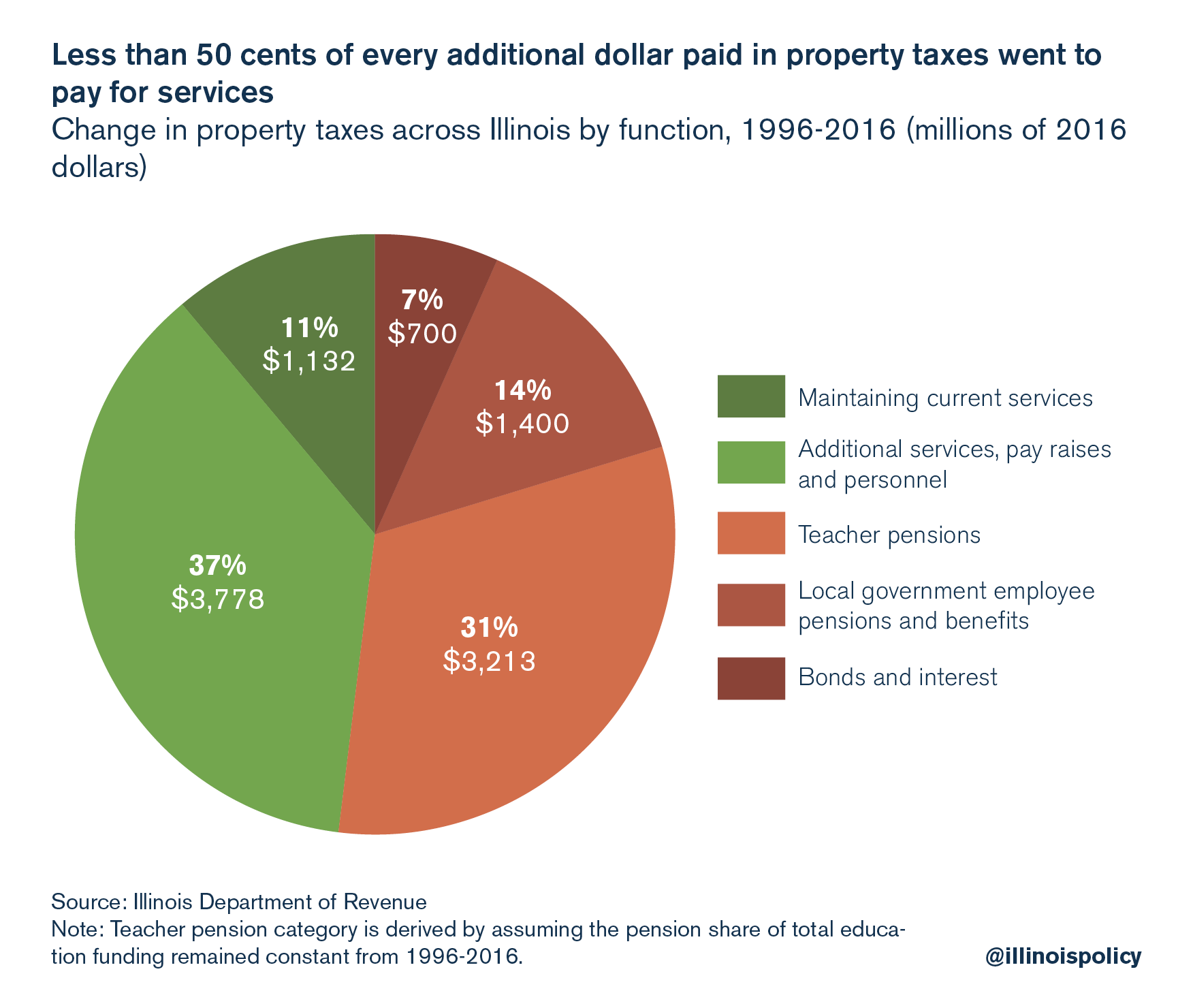

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

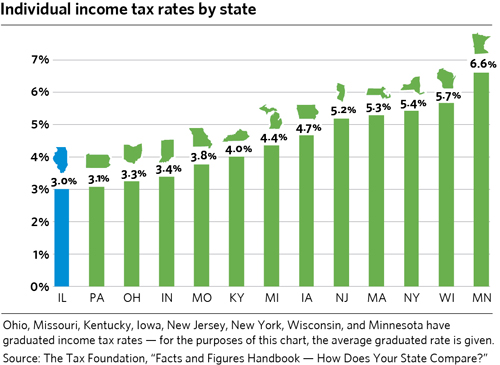

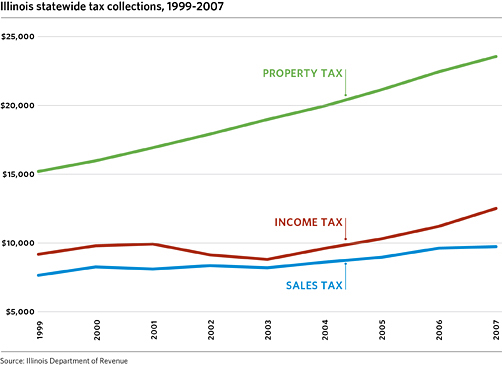

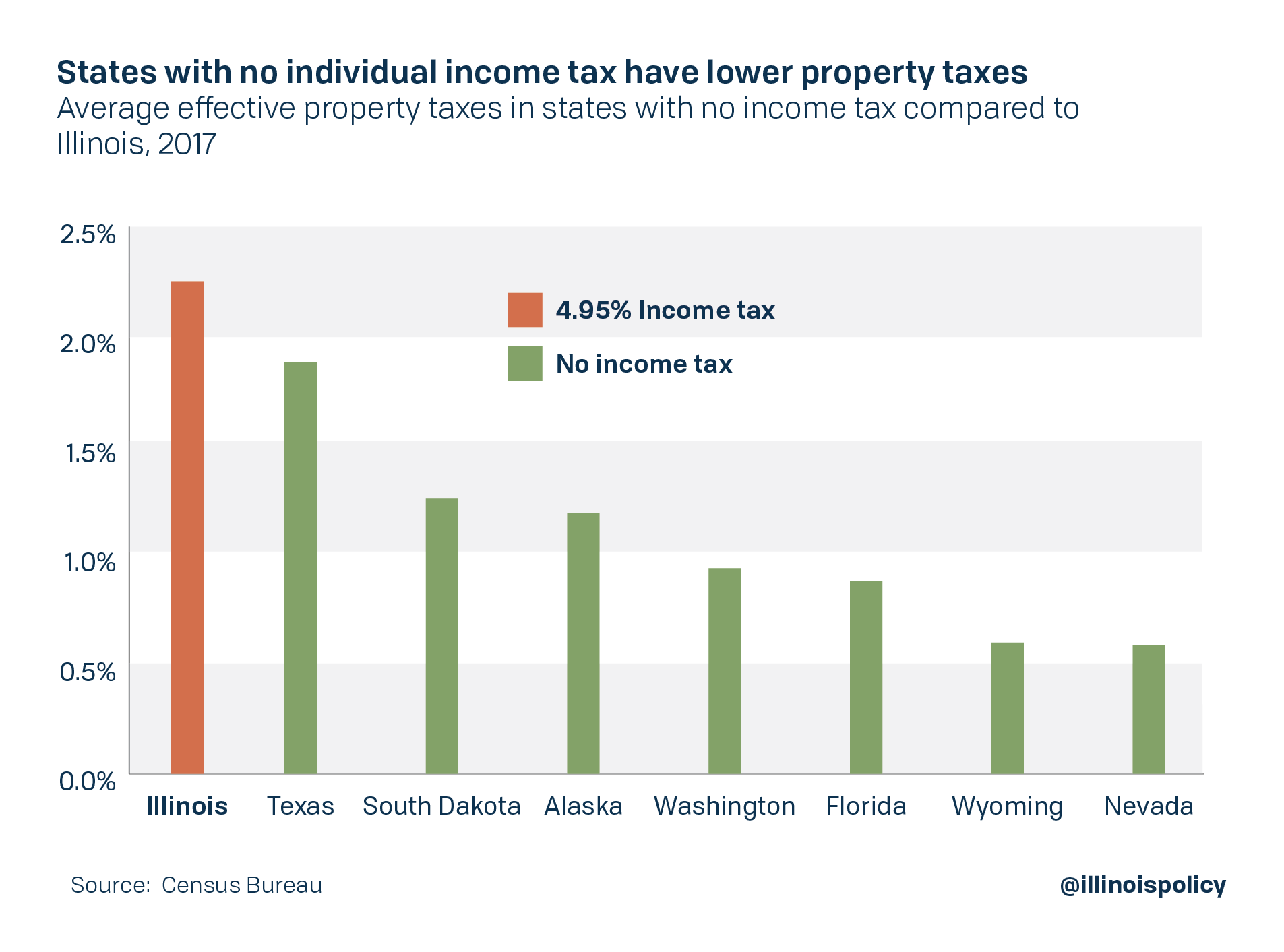

Dusting Off The Income Property Tax Swap Debate Cmap

Taking This Opportunity To Express Our Gratitude For Your Customer Referral To Our Business Quality Barber College We A Irs Taxes Financial Services Tax Help

Illinois Property Tax Exemptions What S Available Credit Karma Tax

Dusting Off The Income Property Tax Swap Debate Cmap

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

Illinois Taxes Illinois Economic Policy Institute Illinois Economic Policy Institute

Governor Pritzker Presents 2023 Budget Including Property Tax Rebates Chicago Association Of Realtors

Illinois Salt Cap Workaround Signed Into Law Wipfli

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running

Illinois Taxes Illinois Economic Policy Institute Illinois Economic Policy Institute

Pritzker Illinois Democrats Budget Agreement Provides 1 83 Billion In Tax Relief For Working Families Governor Says Cbs Chicago

Illinois Senate Democrats Propose 1b Tax Relief Plan Chicago News Wttw